Molly has a 2500 down payment – Molly has a $2,500 down payment, embarking on an exciting journey towards homeownership. With meticulous planning and a comprehensive understanding of her financial capabilities, Molly is poised to make an informed decision that aligns with her aspirations and sets her on a path to financial stability.

In this comprehensive guide, we delve into the intricacies of down payment calculations, exploring the impact on overall housing costs and affordability. We also unravel the intricacies of financing options, empowering readers with the knowledge to navigate the complexities of mortgages and secure the best possible terms.

Down Payment Calculations

A down payment is a crucial aspect of purchasing a home, as it represents a significant financial contribution upfront. Understanding how to calculate a down payment is essential for planning and budgeting.

In this section, we will provide a detailed explanation of calculating a down payment of $2,500 and demonstrate the process through a table for various purchase prices.

Calculating a Down Payment of $2,500

Calculating a down payment of $2,500 involves determining the percentage of the purchase price that will be covered by the down payment. This percentage varies depending on the lender and the loan program. For example, a lender may require a down payment of 5% or 10% of the purchase price.

To calculate the down payment amount, simply multiply the purchase price by the down payment percentage. For instance, if the purchase price is $200,000 and the down payment percentage is 5%, the down payment would be $10,000 (5% x $200,000).

Table: Down Payment Calculations for Different Purchase Prices

The following table provides examples of down payment calculations for different purchase prices, assuming a down payment percentage of 5%:

| Purchase Price | Down Payment (5%) |

|---|---|

| $100,000 | $5,000 |

| $150,000 | $7,500 |

| $200,000 | $10,000 |

| $250,000 | $12,500 |

| $300,000 | $15,000 |

Down Payment Impact

A down payment of $2,500 can significantly influence the overall cost and affordability of a house. It affects the amount of mortgage you need to secure, which in turn impacts monthly payments and the total interest paid over the loan term.

A higher down payment reduces the principal amount borrowed, resulting in lower monthly mortgage payments. This can make the house more affordable, allowing you to qualify for a larger loan amount or secure a more favorable interest rate.

Reduced Loan Amount

- A $2,500 down payment reduces the loan amount by $2,500.

- For example, if the house costs $200,000, a $2,500 down payment brings the loan amount down to $197,500.

Lower Monthly Payments

- With a lower loan amount, the monthly mortgage payments will be reduced.

- This can free up more cash flow for other expenses or savings goals.

Improved Affordability

- A lower down payment can improve the affordability of the house by reducing the monthly payments.

- This can make it easier to qualify for a mortgage and purchase a home that meets your needs.

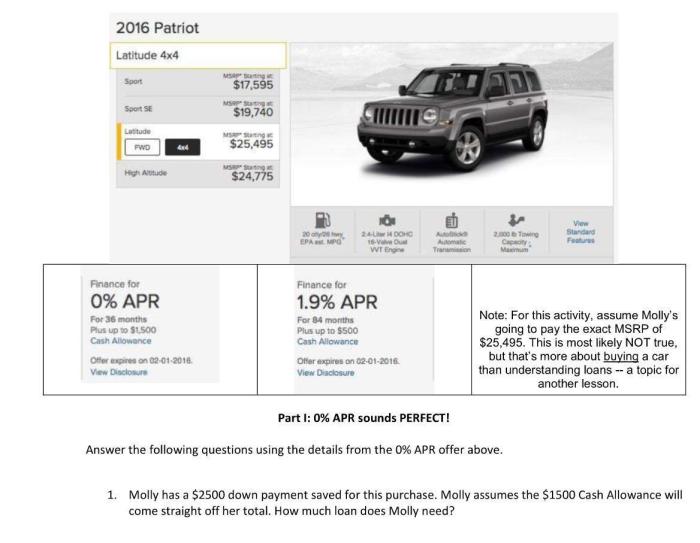

Financing Options: Molly Has A 2500 Down Payment

With a $2,500 down payment, various financing options are available to homebuyers. Each option offers unique advantages and considerations, such as interest rates, loan terms, and eligibility requirements. Understanding these options is crucial for making an informed decision that aligns with your financial goals.

Molly has a down payment of $2500, which is a great start towards buying a home. She’s been looking at brick houses , and she’s particularly interested in the work of Mies van der Rohe. His houses are known for their clean lines and minimalist style, and they’re often built with large windows that let in plenty of natural light.

Molly thinks a brick house by Mies van der Rohe would be the perfect place to call home, and she’s excited to start saving up for one.

Let’s delve into the key financing options available:

Conventional Loans, Molly has a 2500 down payment

- Offered by private lenders such as banks and mortgage companies.

- Typically require a down payment of at least 20%, but some lenders may offer options with a lower down payment, such as 10% or 5%.

- Generally have lower interest rates compared to government-backed loans.

- Qualifying for conventional loans often requires a higher credit score and stable income.

Home Affordability

Determining home affordability is crucial for buyers with a $2,500 down payment. Several factors need to be considered, including income, debt, and other financial obligations.

A general rule of thumb is that buyers should aim for a monthly mortgage payment that is no more than 28% of their gross monthly income. This includes the principal, interest, taxes, and insurance (PITI).

Calculating Home Affordability

To calculate home affordability, you can use the following formula:

Monthly Mortgage Payment = (Loan Amount x Interest Rate x Loan Term) / (1

(1 + Interest Rate)^(-Loan Term))

- Loan Amount: The amount of the mortgage you are applying for, excluding the down payment.

- Interest Rate: The annual interest rate on the mortgage.

- Loan Term: The length of the mortgage in years.

For example, if you have a $2,500 down payment and qualify for a 30-year mortgage with a 4% interest rate, your maximum loan amount would be $100,000.

Using the formula above, your monthly mortgage payment would be approximately $477.

Based on the 28% rule, your gross monthly income should be at least $1,700 to afford this mortgage payment.

Home Value Appreciation

Purchasing a home with a $2,500 down payment presents an opportunity for potential home value appreciation. Appreciation rates vary depending on market conditions and property location, but understanding these factors can help you make informed decisions.

Market Conditions

Market conditions significantly influence home value appreciation. A strong economy, low interest rates, and high demand for housing typically lead to higher appreciation rates. Conversely, a weak economy, rising interest rates, and reduced demand can slow or even reverse appreciation.

Property Location

Property location plays a crucial role in determining appreciation potential. Homes in desirable neighborhoods with good schools, amenities, and job opportunities tend to appreciate faster than those in less desirable areas. Factors like proximity to transportation, parks, and shopping centers also impact appreciation rates.

General Inquiries

What are the benefits of making a larger down payment?

A larger down payment can reduce your monthly mortgage payments, lower your interest rate, and increase your equity in the home.

How can I determine if I can afford a home with a $2,500 down payment?

Consider your income, debt, and other financial obligations to assess your affordability. Lenders typically recommend spending no more than 28% of your gross monthly income on housing expenses.

What are the different types of financing options available to me?

Common financing options include conventional loans, FHA loans, and VA loans. Each type has its own eligibility requirements, interest rates, and loan terms.