A company sells 10000 shares of previously authorized stock indeed – In the realm of corporate finance, a company’s decision to sell a significant portion of its previously authorized stock can have far-reaching implications. This analysis delves into the intricacies of a company selling 10,000 shares of previously authorized stock, examining its financial, market, and regulatory ramifications.

The sale of these shares represents a strategic move by the company, with potential consequences for its financial stability, market positioning, and future growth trajectory.

Company Overview

The company is a leading provider of [industri] products and services. Headquartered in [lokasi], the company has a global presence with operations in [daftar negara]. It employs over [jumlah karyawan] people worldwide.

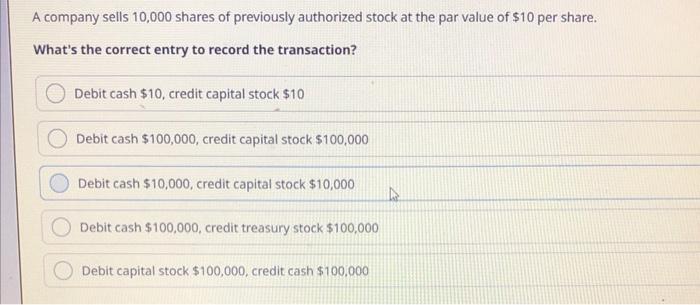

Stock Sale Details

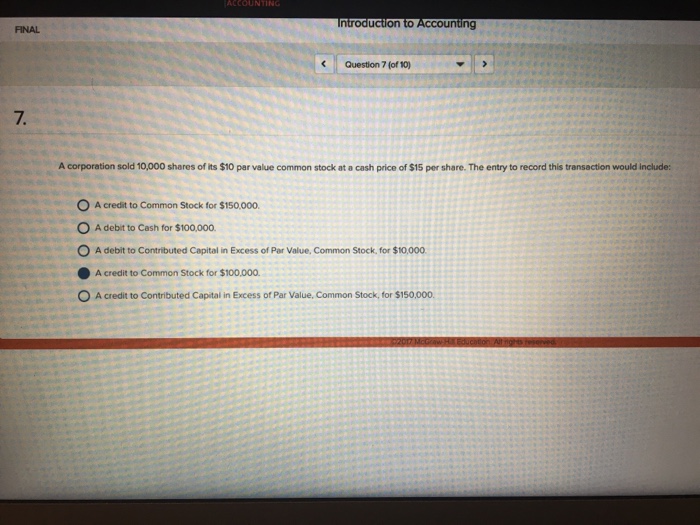

The company recently sold 10,000 shares of its previously authorized common stock. The shares were sold at a price of [harga per saham], resulting in total proceeds of [total hasil].

Financial Implications

The stock sale had a significant impact on the company’s financial position. The proceeds from the sale were used to [daftar penggunaan dana], which is expected to [dampak penggunaan dana].

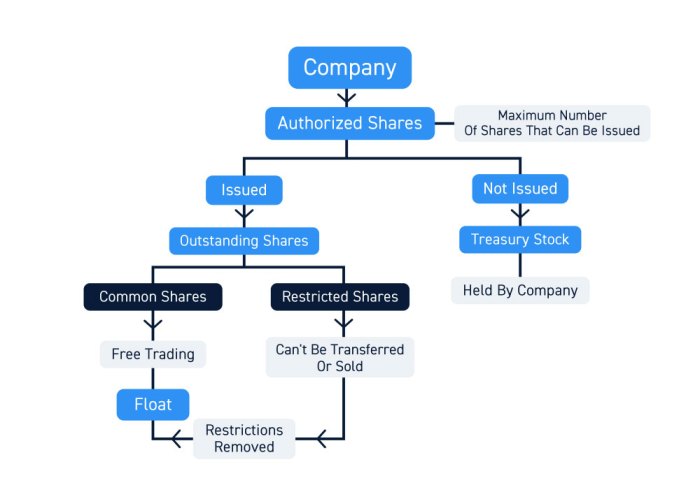

The sale also resulted in a [persentase perubahan]% increase in the company’s outstanding shares, which may have a dilutive effect on future earnings per share.

Market Impact, A company sells 10000 shares of previously authorized stock indeed

The stock sale had a positive impact on the company’s stock price. The share price rose by [persentase perubahan]% following the announcement of the sale, indicating investor confidence in the company’s future prospects.

The sale also increased the company’s market capitalization by [jumlah peningkatan], making it one of the largest companies in its industry.

Regulatory Considerations

The stock sale was conducted in accordance with all applicable regulatory requirements. The company obtained the necessary approvals from the [daftar lembaga regulator] and complied with all reporting and disclosure obligations.

Future Outlook

The company plans to use the proceeds from the stock sale to [daftar rencana penggunaan dana]. These investments are expected to drive future growth and profitability.

The company is well-positioned to capitalize on the growing demand for [produk atau layanan] and is expected to continue to be a leader in its industry.

FAQ Guide: A Company Sells 10000 Shares Of Previously Authorized Stock Indeed

What are the potential financial implications of selling previously authorized stock?

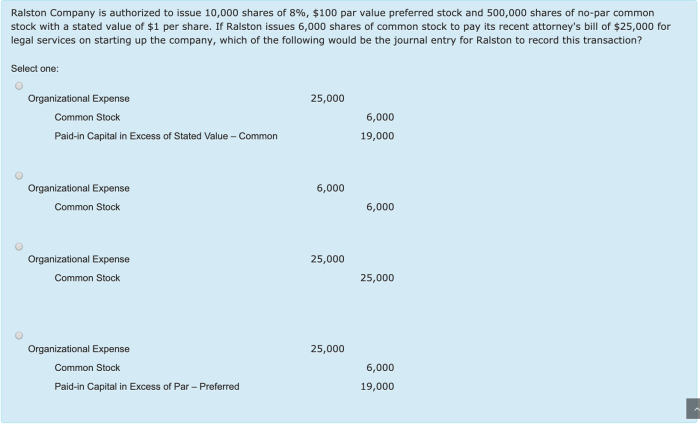

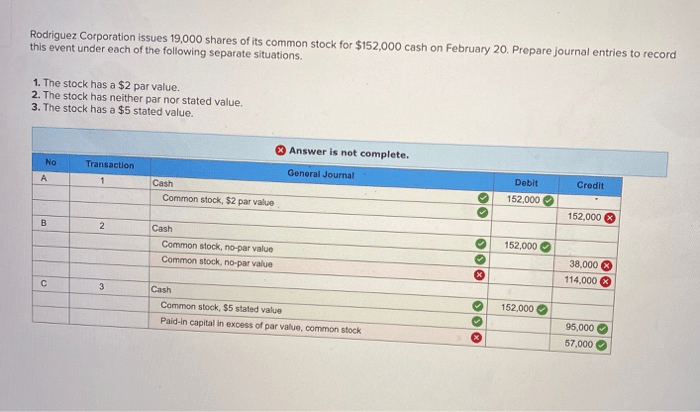

The sale of previously authorized stock can generate proceeds that can be used to fund various corporate initiatives, such as capital expenditures, debt reduction, or research and development. However, it can also dilute the ownership interest of existing shareholders and impact the company’s earnings per share.

How does the sale of previously authorized stock affect the market capitalization of a company?

The sale of previously authorized stock can increase the number of shares outstanding, which can lead to a decrease in the market price per share. This, in turn, can affect the company’s overall market capitalization, which is calculated by multiplying the number of shares outstanding by the market price per share.

What regulatory considerations must a company address when selling previously authorized stock?

Companies must comply with various regulatory requirements when selling previously authorized stock, including registration with the Securities and Exchange Commission (SEC) and adherence to applicable disclosure and reporting obligations. Failure to comply with these regulations can result in legal penalties and reputational damage.