Mr. white has medicare parts a and b – Mr. White’s Medicare coverage under Parts A and B provides him with essential health insurance benefits. Understanding the specifics of each part, including covered services, costs, and limitations, is crucial for maximizing his healthcare protection. This comprehensive guide will delve into the intricacies of Medicare Parts A and B, empowering Mr.

White to make informed decisions about his healthcare.

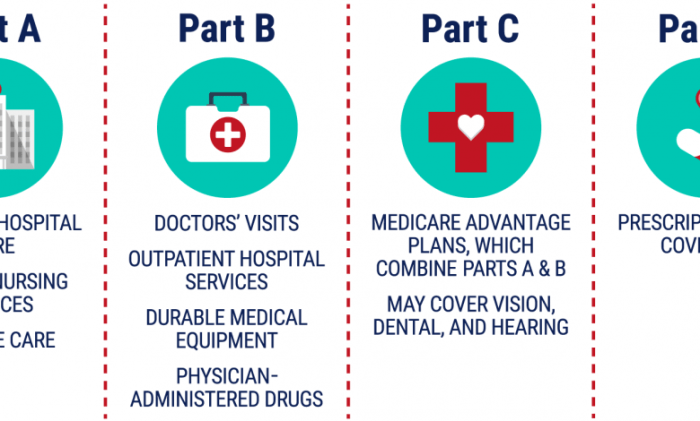

Medicare Part A, also known as Hospital Insurance, covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Part B, or Medical Insurance, provides coverage for outpatient medical services, such as doctor visits, preventive screenings, and durable medical equipment.

Together, these parts form the foundation of Mr. White’s Medicare coverage.

Mr. White’s Medicare Coverage: Mr. White Has Medicare Parts A And B

Mr. White is enrolled in Medicare Part A and Part B. Medicare Part A, also known as Hospital Insurance, covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care. Medicare Part B, also known as Medical Insurance, covers medically necessary services, such as doctor visits, outpatient care, durable medical equipment, and preventive services.

Services Covered by Medicare Part A

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Home health care

Services Covered by Medicare Part B

- Doctor visits

- Outpatient care

- Durable medical equipment

- Preventive services

Limitations and Restrictions

Medicare Part A and Part B have certain limitations and restrictions. For example, Medicare Part A does not cover long-term care, such as nursing home care. Medicare Part B does not cover routine dental care, eyeglasses, or hearing aids.

Medicare Part A and Part B Costs

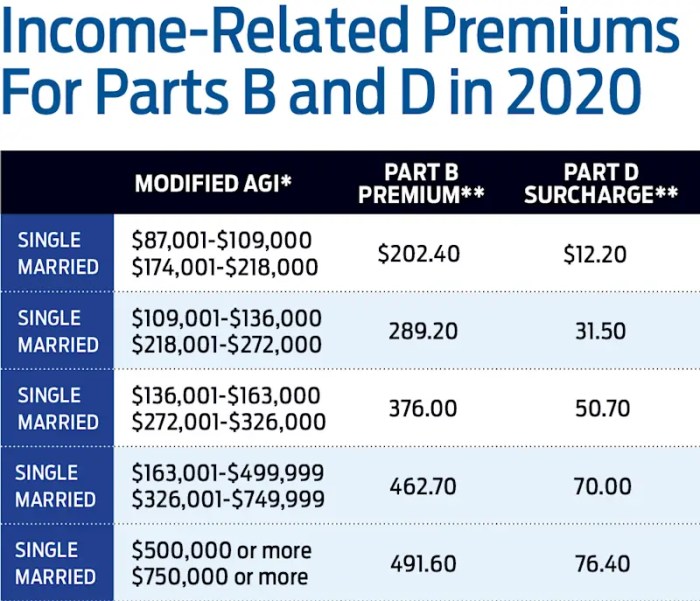

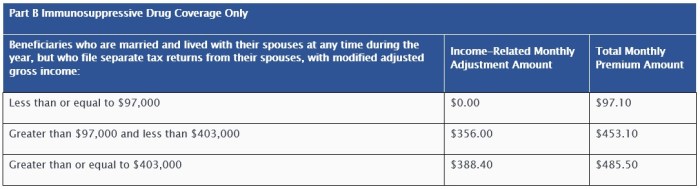

Medicare Part A and Part B are the two main parts of Medicare, the federal health insurance program for people aged 65 and older. Part A covers hospital insurance, while Part B covers medical insurance. The costs of Medicare Part A and Part B are determined by a number of factors, including the individual’s income, age, and health status.

Part A Costs

Part A premiums are based on an individual’s income. The higher the income, the higher the premium. In 2023, the standard monthly premium for Part A is $278. However, individuals who have worked and paid Medicare taxes for at least 30 quarters may be eligible for premium-free Part A.

Part A also has a deductible, which is the amount an individual must pay out-of-pocket before Medicare begins to cover costs. The deductible for Part A is $1,600 in 2023. After the deductible is met, Medicare will cover 80% of the approved costs for hospital stays, skilled nursing facility care, and hospice care.

The individual is responsible for the remaining 20% of the costs.

Part B Costs

Part B premiums are based on an individual’s income and age. The higher the income, the higher the premium. In 2023, the standard monthly premium for Part B is $164.90. However, individuals who have worked and paid Medicare taxes for less than 30 quarters may be eligible for a higher premium.

Part B also has a deductible, which is the amount an individual must pay out-of-pocket before Medicare begins to cover costs. The deductible for Part B is $233 in 2023. After the deductible is met, Medicare will cover 80% of the approved costs for doctor visits, outpatient care, and durable medical equipment.

The individual is responsible for the remaining 20% of the costs.

Additional Expenses

In addition to premiums and deductibles, individuals may also incur other expenses under Medicare Part A and Part B, such as coinsurance and out-of-pocket expenses. Coinsurance is a percentage of the cost of a covered service that the individual is responsible for paying.

Out-of-pocket expenses are costs that are not covered by Medicare, such as the cost of private nursing care or prescription drugs.

Medicare Coverage Options for Mr. White

Medicare Advantage (MA) plans are private health insurance plans that contract with Medicare to provide Part A and Part B benefits, and often additional benefits such as dental, vision, and hearing coverage. Mr. White has several MA plan options to choose from, each with its own benefits, costs, and coverage options.

Medicare Advantage Plans Available to Mr. White

The following table compares the benefits, costs, and coverage options of three Medicare Advantage plans available to Mr. White:| Plan | Monthly Premium | Annual Deductible | Coinsurance | Out-of-Pocket Maximum | Additional Benefits ||—|—|—|—|—|—|| Plan A | $150 | $500 | 20% | $6,700 | Dental, vision, and hearing coverage || Plan B | $100 | $1,000 | 30% | $7,550 | Dental and vision coverage || Plan C | $50 | $1,500 | 50% | $8,550 | None |

Pros and Cons of Each Plan

Plan A* Pros:

Low monthly premium

Comprehensive coverage

Cons

High annual deductible

High out-of-pocket maximum

Plan B* Pros:

Moderate monthly premium

Moderate annual deductible

Moderate out-of-pocket maximum

Cons

Less comprehensive coverage than Plan A

Plan C* Pros:

Low annual deductible

Low out-of-pocket maximum

Cons

High monthly premium

No additional benefits

Alignment with Mr. White’s Needs and Preferences

Mr. White should consider his health needs, budget, and preferences when choosing a Medicare Advantage plan. If he has frequent medical expenses, Plan A may be a good option despite its higher premium and deductible. If he has a limited budget, Plan B or C may be more suitable.

If he values comprehensive coverage, Plan A is the best choice. Ultimately, the best plan for Mr. White will depend on his individual circumstances.

Supplemental Insurance for Mr. White

Medicare Supplement insurance (Medigap) is a type of private health insurance that can help pay for out-of-pocket costs associated with Original Medicare (Part A and Part B).

There are different types of Medigap plans available, each with its own benefits, costs, and coverage options. Mr. White can choose the plan that best meets his needs and budget.

Types of Medigap Plans, Mr. white has medicare parts a and b

- Plan A: Covers the Part A deductible and coinsurance, as well as some Part B coinsurance and deductibles.

- Plan B: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles.

- Plan C: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, plus an additional 50% of the Part B deductible.

- Plan D: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, plus an additional 75% of the Part B deductible.

- Plan F: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, plus an additional 100% of the Part B deductible.

- Plan G: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, plus an additional 80% of the Part B deductible.

- Plan K: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, except for a small copayment for each doctor visit.

- Plan L: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, except for a small copayment for each doctor visit and a small deductible for each hospital stay.

- Plan M: Covers the Part A deductible and coinsurance, as well as all Part B coinsurance and deductibles, except for a small copayment for each doctor visit, a small deductible for each hospital stay, and a small copayment for each day spent in a skilled nursing facility.

The premiums for Medigap plans vary depending on the type of plan, the insurance company, and Mr. White’s age, health, and location.

Mr. White should carefully consider his needs and budget when choosing a Medigap plan. He can talk to an insurance agent or broker to get more information about the different plans and to find the best plan for him.

Resources for Mr. White

Mr. White can access a wealth of information and support to help him navigate Medicare. Numerous reputable organizations and websites provide comprehensive resources, including:

- Medicare.gov:The official website of the Centers for Medicare & Medicaid Services (CMS), providing detailed information about Medicare coverage, benefits, and enrollment.

- National Council on Aging:A non-profit organization dedicated to providing information and resources on aging-related issues, including Medicare.

- AARP:A membership organization for people over 50, offering a range of resources and support services related to Medicare.

- State Health Insurance Assistance Program (SHIP):A federally funded program that provides free, unbiased counseling and assistance to Medicare beneficiaries.

Local Medicare Offices and Counselors

Mr. White can also contact his local Medicare office or consult with a Medicare counselor for personalized guidance. Medicare offices can assist with enrollment, claims processing, and other administrative matters. Counselors can provide comprehensive information about Medicare coverage options, benefits, and potential costs.

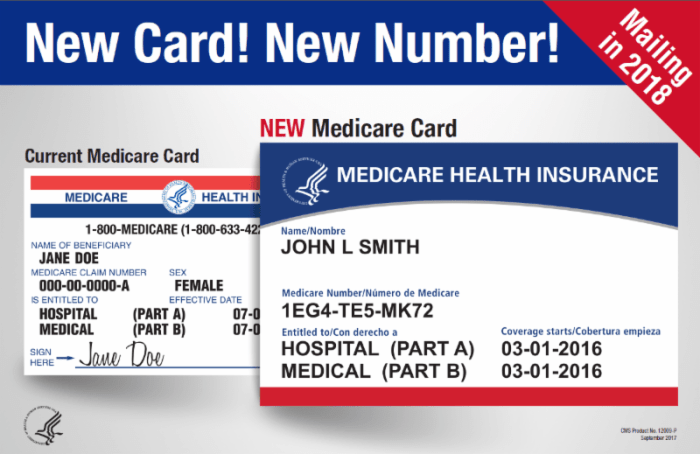

To find a local Medicare office or counselor, Mr. White can visit the Medicare website or call 1-800-MEDICARE (1-800-633-4227).

Online Tools and Resources

Several online tools and resources can help Mr. White manage his Medicare benefits effectively. These include:

- MyMedicare.gov:A secure online portal that allows Medicare beneficiaries to view their coverage information, manage their benefits, and track claims.

- Medicare Savings Finder:A tool that helps Medicare beneficiaries compare prescription drug plans and find the most cost-effective options.

- Medicare Plan Finder:A tool that helps Medicare beneficiaries compare Medicare Advantage and Part D prescription drug plans based on their specific needs and preferences.

By utilizing these resources, Mr. White can gain a comprehensive understanding of his Medicare coverage options and make informed decisions about his healthcare needs.

Key Questions Answered

What are the premiums for Medicare Parts A and B?

Premiums vary depending on income and enrollment status. Part A is typically premium-free for those eligible, while Part B premiums are deducted from Social Security benefits.

What is the deductible for Medicare Part A?

There is no annual deductible for Medicare Part A.

What is the copayment for Medicare Part B?

The Part B copayment is 20% of the Medicare-approved amount for covered services.